Real Estate Investing is Never a Straight Path

And it almost always takes the right team with the right experience to get you where you want to go.

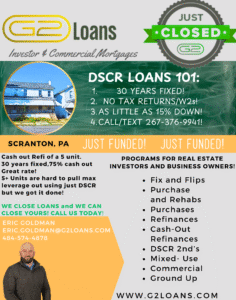

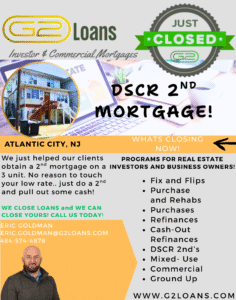

At G2 Loans, we specialize in providing lending solutions tailored to meet the diverse needs of real estate investors and commercial property buyers. Our 60+ years of combined experience and relationship-based approach ensure that you receive the best financing options available for your precise situation. Whether you’re looking to fix and flip a property, invest in commercial real estate, or undertake a new construction project, G2 Loans is your trusted partner.

Why Choose Our Lending Solutions?

Simply put: We Succeed when you succeed.

Whether you are a residential or commercial buyer, we’re with you every step of the way. We help veteran investors and entry level investors get on the path to success.

- Quick Approvals and Funding: Unlike traditional bank loans, our lending solutions can be approved and funded quickly, allowing you to seize investment opportunities without delay.

- Flexible Terms: We offer flexible loan terms that can be customized to fit your specific needs and investment goals.

- Asset-Based Lending: Our loans are based on the value of the property, not only your credit score, making it easier for self-employed individuals, investors and those with unconventional financial backgrounds to secure funding.

- With You Every Step of the Way: We work hand in hand with our investors, navigating the loan process, assist with negotiations and process the paperwork.

Common Investment Initiatives We Support

Recent Success Stories

From the Blog

We are passionate about all thing’s investor and commercial real estate. Check out our latest tips, suggestions and more from the blog.

Decided to Make That Move? Now is the Time to Make Your First Deal!

When a veteran investor is speaking at a real estate meetup one of the most asked questions is: What was the hardest thing about starting…

Is It a Good Time to Make a Move?

Spoiler….. it is always a good time to make a move! One of the major questions on every real estate investor’s mind is: Should I…

DSCR Loans: 30 Years Fixed

A Debt Service Coverage Ratio (DSCR) loan is a type of mortgage commonly used by real estate investors to purchase or refinance rental properties. It’s…